Steering Clear of Bookkeeper Liability Hazards

Mar 26, 2018

For some business owners, bookkeeper liability could be cause for concern. Whether you maintain the books for your own company or delegate that task to an internal or outsourced bookkeeper, it pays to understand the responsibilities inherent in the role. After all, protecting your most valuable assets — your employees — is critical to keeping your business successful.

Insufficient Funds

A check might bounce because the payer doesn’t have a dedicated bookkeeper who minds the finances. However, vendors still expect to receive their payments on time, even in such an instance. According to the Uniform Commercial Code, an authorized representative (i.e., one with check-signing authority) is personally liable to the payee unless the representative can prove that the company did not intend for them to assume that responsibility.

What to watch for: To protect the bookkeeper from personal liability, consider requiring each check to have a second signature from a supervisor or corporate officer.

Unpaid Payroll Taxes/Withholdings

Worker classification is one of the IRS’s hot-button issues, and the agency scrutinizes business tax returns for red flags. If a company claims that employees are independent contractors and the IRS later reclassifies those workers as employees, then who is liable for the unpaid payroll taxes? Consider another scenario: A company short on cash pays its vendors before remitting payroll tax withholdings to the IRS. Who is responsible for that decision?

In both scenarios, the IRS could hold bookkeepers personally liable for 100% of any trust fund taxes (i.e., employees’ Social Security, Medicare, and withheld income taxes) if they:

- are “responsible parties” with decision-making authority (in other words, as a check-signer, they decide which checks to send out), or

- willingly did not pay the taxes, even if a corporate officer directed them not to do so.

What to watch for: If possible, refrain from designating bookkeepers as authorized check signers or require a supervisor or a corporate officer to sign checks. If you are a business owner who performs your bookkeeping, then you may not be able to claim that you have no decision-making authority or did not know the taxes were due. Instead, protect yourself from personal liability by understanding the risks associated with the role.

Data Breaches

Companies that outsource their bookkeeping should be aware of the data security risks of doing so. If bookkeepers who store private client information on their networks become victims of a security breach, the data could be disclosed, damaged, or lost. These attacks can trigger breach notification requirements and penalties for violating state and federal privacy and security regulations.

What to watch for: Ensure your bookkeeper has strong data security practices, including a written policy for handling confidential information.

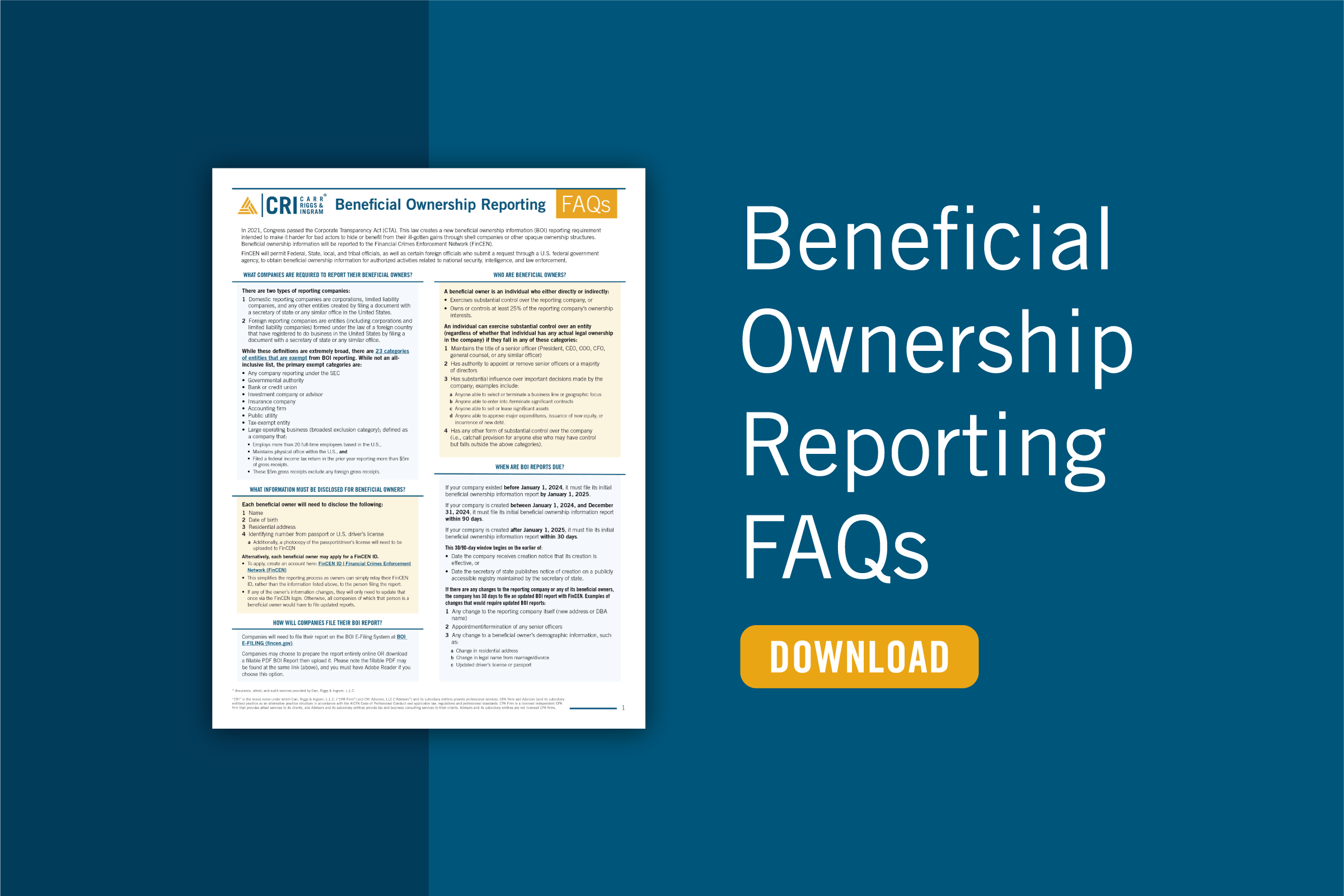

CRI Can Help With Bookkeeping Liability Hazards

Running a profitable company means watching out for anything that could derail your most important assets — including your and your employees’ personal capital. Contact CRI to learn how our client accounting services can help keep your business on track.